"Makeena, a lifestyle technology company dedicated to connecting brands and shoppers for good, today launched a Kickstarter crowdfunding campaign for its powerful location-aware app that helps shoppers save money on healthy and sustainable products." To find out more about Makeena and how to support them, visit the full story here.

Why Happiness is the New Productivity (The Story of Mindvalley)

Vishen LakHiani, founder of MindValley, has created the ultimate expression of joy and happiness in corporate form.

His methods for empowering and growing his team are mind blowing. Mind Valley, a certified WorldBlu most democratic company is beyond incredible.

Weekly meetings with readings of The Awesomeness report, team Bali vacations, crowdsourced bonuses. They've had massive growth and this was 2009.

They've created Mindvalley Academy - The world’s first online university for transformational education. And then there's the Awesomeness Fest... I love them.

One of the best talks I've seen.

In 2009 Vishen Lakhiani was asked to speak at Engage Today in Calgary along with such luminaries as Sir Richard Branson, His Holiness the Dalai Lama, Stephen Covey, Nobel Prize Winner F.W De Klerk, Tony Hsieh, the founder of Zappos.com and world-famous artist Wyland.

Meet 500 Startups’s Female-Led Startup from the Middle East: Silkroad Images

This woman is so savvy. I love that she went full on and incorporated in Delaware, went to Silicon Valley and got into 500Startups. She's found a perfect niche, offering stunning stock photography to meet the needs of the Arab world. She's now back in Turkey where 38% of entrepreneurs are women while we're only 10%.

Here's her story reported by Kira M. Newman for the San Francisco Edition.

Mahafzah first heard of 500 Startups when she was in Silicon Valley, on the heels of winning the MIT Arab Startup Competition. Scheduled for a month of incubation from Google for Entrepreneurs and TechWadi, she ended up staying six months and learned more about the US startup scene.

So she did what any self-respecting entrepreneur in the US does: incorporate in Delaware and apply for an accelerator. 500 Startups rejected her the first time, but she was in for batch 10.

Jordan has accelerators that Mahafzah could have applied for, but Silicon Valley has something that’s lacking in Jordan: early-stage investment.

“The startup scene in Jordan is not that late behind the Silicon Valley,” says Mahafzah. “We have smart entrepreneurs, great startups, and good accelerators with almost Silicon Valley standards – but what we lack back home or the whole [Middle East and North Africa] region is the right seed funding.”

(And if you’re wondering, Mahafzah didn’t find Jordan lacking in opportunities for women. While Silicon Valley has 10% women entrepreneurs, she says that almost 38% of startups in Jordan have female founders.)

Mahafzah, who spent 13 years in advertising, sees beyond the Middle East market: she imagines expanding first into Turkey and then into Asia as well. And she knows that, while her clients are advertisers and media, she has a broader purpose.

“We are aiming to digitally archive the heritage and the image of the East,” she says."

Can Women Succeed in the Tech Industry?

"It’s hard out there for women in technology. Only a fraction of the estimated 120,000 computer science graduates in the U.S. each year are women and that number has dropped since significantly since 1985. Though more female-founded startups are popping up everyday, just 5 percent of all tech startups are led by women, according to a 2012 Kauffman Foundation report.

Clearly there are major barriers for women in technology, but three of the highest-paying jobs for women OVERALL are in the tech sector. There is a lot of opportunity for women to thrive in this field. As part of their Women Invent Tomorrow campaign, Silicon Republic put together some pretty interesting and impressive facts on the state of women in technology today. From salary information, to skills you need, to notable women in the tech field, this is the information on women in technology you need to know......" Read the rest of the article here.

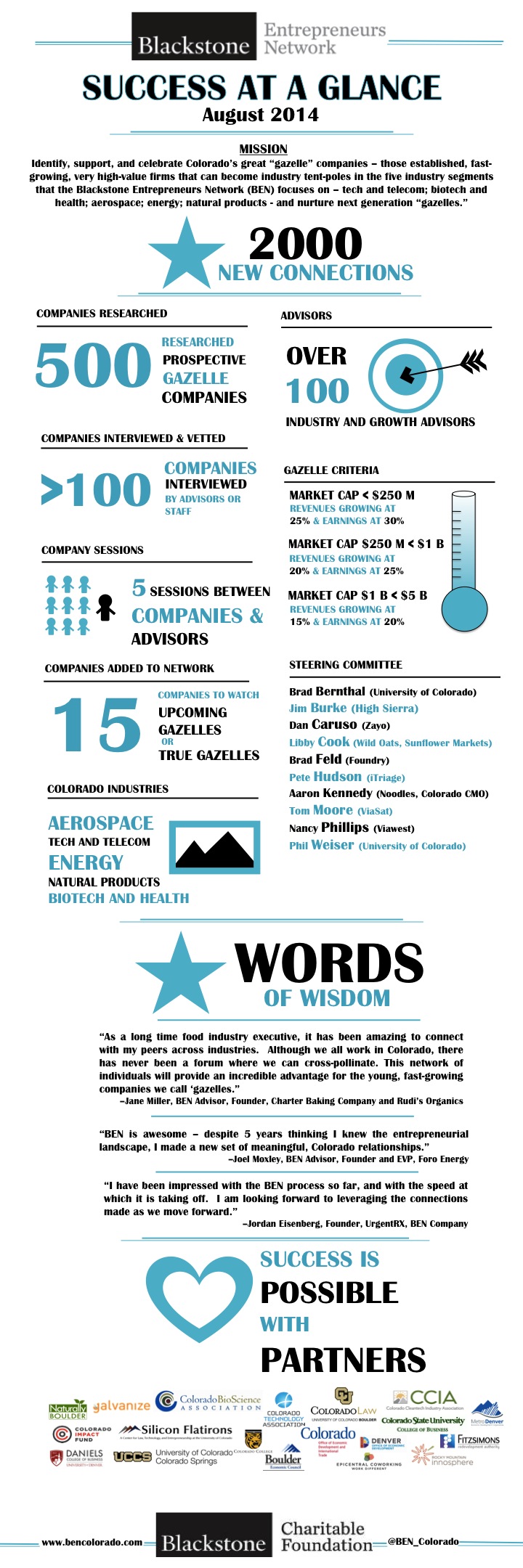

Blackstone Entrepreneur Network - Check out BEN's successes

BEN is based on the premise that density of networks creates economic growth. Based on what they've already accomplished and the people they've brought together, it looks like we'll have many more good years to come...

The Blackstone Entrepreneurs Network (BEN) has exceeded expectations and has made 2,000 connections - adding over 120 Advisors, 15 Companies, and 20 Partner Organizations.

HALO Reports Shows Trends in Angel Groups

Who are the most active angel groups?

What impact are angel investors having on early stage funding?

What industries and regions are trending?

Find out...

The HALO report 2014 shares all of the Q1 trends and highlights.

The Daily Routines of Famous Creative People

Art of Leverage Interview with Dr. Patricia Klauer

Art of Leverage Interview with Dr. Patricia Klauer

Patricia is a Doctor of Chiropractic; a specialist in Enterprise Information Architecture; and a dedicated practitioner and teacher of the meditative arts who has been meditating for 30 years and using meditation as an essential foundation for her career. In her technology career, Patricia is an expert in designing data warehouse architecture for large-scale enterprises and has worked with companies such as Genentech, Wells Fargo Bank, McKesson Corporation, Fidelity Investments, UNDP United Nations Development Programme, NCR, Swiss Bank, Barclay’s Bank and First Boston Corporation to name a few. In this capacity she founded http://www.eclipsedatasystems.com/ a large-scale data integration and data warehousing firm; is co-author of “Building Data Warehouses for Decision Support,” published by Prentice Hall and was a founding member of Social Fusion, a non-profit organization that networks individuals and organizations to promote social entrepreneurism worldwide.

As a visionary leader, Dr. Klauer brings a breadth and depth of experience, insight and understanding to every initiative. As an experienced information architect she seeks to bridge the divide between IT and business to emphasize core business objectives and foster alignment, communication and resilience into the technology platforms she designs. Through transparency and collaboration her technical solutions not only support business needs, but delight the business community and evoke pride and sense of stewardship from IT.

After 20 years of experience in data warehousing she has discovered the biggest challenges are not technical, even though that is where the focus and the money is spent. The true challenge is always personal and organizational – and organizational is always personal. Almost always the “solution” required is a shift in the current mental model and an alignment of many influencing factors. Building resilient frameworks that serve business objectives are very similar to the need to individually cultivate resilience in your personal life - balancing health, home, friends and work in a way that not only sustains you as a person but enlivens, enriches and empowers you and all others you touch.

Patricia has designed practices to cultivate personal resilience specifically oriented towards professionals who are too busy to meditate but need it the most. She understands this culture and the daily challenges because she has personally lived this way and continues to serve her own corporate clients in the technology world. The ‘Walk in the World’ program empowers others to discover their own personal resilience, which she describes as the capacity to find balance and equanimity in the face of extreme stress, manage their energy and discover inspiration, insight and creativity. She guides others to tap into their own hidden inner resources through simple and natural mind body practices and apply these practices on a regular basis. She is inspired and committed to share with others her direct experience and how to cultivate resilience into your personal and working life. www.patriciaklauer.com

Entrepreneurial kids – Growing a next generation of masterminds

A couple weeks ago I had the chance to speak to some amazing kids who are part of a sleepover accelerator based out of Boulder, Camp Inc. These kids had amazing ideas and some of them were already serial entrepreneurs. Check out Val Weisler who created The Validation Project, a global movement.

Entrepreneurship is definitely becoming the trendy new thing. And, it's here for good. It's the one thing that will save our planet and make the changes we need to see happen. And here's why, it gets us to think outside of the box. It gets us to think about what can be.

In this video, Cameron sheds light on how entrepreneurs are distinguishable from a young age and should not be forced into the mould required by societal standards.

He then proceeds to mention brilliant methods as to how we can instill the entrepreneurial mindset of being tenacious and opportunistic (among others) to the children of our age.

50 VC & Angel Investors Every Entrepreneur Should Know

I love this impressive list Alley Watch has put together of the top 50 investors.

"50 VC and Angel Investors Every Entrepreneur Should Know

BY JARED O'TOOLE · FEBRUARY 8, 2013

What’s the next big thing? There’s a good chance someone on this list is either starting it or funding it. The investors below have been a there as founders or investors for many of the companies that have shaped the internet like Amazon, eBay, AOL, Paypal, Facebook, Twitter, Google and many more. These investors have had incredible success and are major players in the tech industry....READ MORE

The Top 20 Angel Investors

CB Insights analyzed the top 2000 angel investors and then share the top 1% in this fascinating article.

We analyzed over 2000 angel investors on factors such as network strength, rate of follow-on investment, # of exits, brand and more. Here's how angel investors stack up.We previously looked at ranking corporate VCs, micro VCs and AngelList syndicates using the same algorithms we use to assess financial or pure-play VCs and today we’re turning ourInvestor Mosaic algorithms onto individual angel investors.

Specifically, we analyzed 2000 individual angel investors and looked at Investor Mosaic factors such as an investor’s stage of entry, past exits, network centrality, and brand, among other things, in order to understand who the top angels really are.

The top-ranked angels included well-known names such as Naval Ravikant, Ashton Kutcher, Tim Ferriss, and David Tisch as well as some lesser-known names as you will see below. As always, the data in this brief all comes from CB Insights.

The analysis is broken down as follows:

- Which angels have the best network?

- Which angels have the highest investment follow-on rate?

- The Top 20 Rankings

- What sectors & industries are the top angels focused on?

- Where are top angel investors investing – geographically?

Strength of Network – Alexis Ohanian Leads

Academics have found that the strength of a VC’s network is a key determinant of investor success. Having a strong network for an angel investor means better deal-flow, access to better information, syndicate partners and follow-on investors. The network centrality algorithm is akin to the initial Google Pagerank algo. Simplistically, it measures the breadth of connections an investor has (the sheer # of connections) and the quality of those links, i.e. having investments get follow-on funding from Sequoia Capital is worth more than Joe Schmoe VC.

Below are the top 20 angel investors based on their Network Centrality scores. Using the CB Insights Investor Syndicate Dashboard, we can also see which VCs tend to follow-on to each angel’s companies most frequently.

Alexis Ohanian, founder of social news site Reddit, ranked first in Network Centrality among all angels, with New Enterprise Associates, Google Ventures, and First Round Capital following-on to his investments most frequently.

Also of note, 6 of the top 20 angels by network centrality had affiliations with famed accelerator Y Combinator. These angels included Y Combinator’s current President, Sam Altman, current/past Partners Garry Tan, Geoff Ralston, Paul Buchheit, and Harj Taggar, and Ambassador Alexis Ohanian.

Of the follow-on investors, First Round Capital was the most-frequent indicating the firm’s strong ties to prominent angel investors. Andreessen Horowitz and SV Angel rounded out the top 3.

Bobby Yazdani Tops Follow-On Rates

Another important dimension beyond network centrality to evaluate angel investors is their ability to get their portfolio companies follow-on funding. When analyzing all angel investor’s with 10+ investments that were eligible for follow-on funding (investment made >13 months ago and which remained private), Bobby Yazdani ranked first with over 80% of his portfolio receiving follow-on funding.

The top 5 was rounded out by Larry Augustin, Matt Coffin, Ashton Kutcher, and Gil Penchina. Three of the top 5 investors by follow-on rate are current or former entrepreneurs with the previously mentioned Yazdani founding SecondMarket.com, Augustin founding VA Software, and Coffin founding LowerMyBills.com,

The Rankings

Naval Ravikant ranked #1 out of over 2000 angel investors

After taking into account network centrality, follow-on rates and other factors included in Investor Mosaic, we were left with a list of the top 20 angel investors. Naval Ravikant, the entrepreneur behind Genoa Corp, Epinions.com, Vast.com, and most recently, AngelList, ranked first in our analysis of Angel Investors. With investments in notable companies such as Twitter and Uber, Naval’s investments cover a wide array of up-and-coming startups, mature technology companies, and notable exits. His investing prowess led him to the top 3 spots across multiple categories in our Investor Mosaic rankings, and ultimately to #1 among all Angels.

It’s worth noting that past performance along with network centrality and follow-on investment rate is an important determinant of which angels are the best. In private markets where information asymmetry can be significant, it has been shown by academicians that “past performance does, in fact, help predict future performance” so having a track record is critical.

The top 1% of angels are featured below (20 out of over 2000).

The top 20 angel investors participated in over 540 deals from 2009 to 2013. Naval Ravikant was the most prolific of the top 20 in that time, with over 75 investments, while David Tisch and Paige Craig rounded out the top 3 on a deals basis.

Top 20 Angels’ Focused on Internet & Mobile

In terms of industries, the top 20 angels are investing heavily in Internet, Mobile, and eCommerce, with those three industries making up 91% of deals and funding. Of note, Social was the most popular sub-industry among the top 20, with investments into companies such as Klout and Nextdoor driving that trend.

Where Are The Top Investing? – 51% of Deals in Silicon Valley

The Top 20 investors also were fairly concentrated in terms of geography over the last 5 years, with 51% of all deals taking place in Silicon Valley-based companies. New York was second with 21%, while Southern California was third with 8% of all deals. International startups also received more investments than Massachusetts, with Esther Dyson leading the top 20 in international investments including participation in early-stage rounds for Russia-basedOstrovok and Finland-based Valkee, among others.

We’re already seeing VCs and other investors who are looking for dealflow trying to better understand the angel investment ecosystem so they can more strategically cultivate relationships with the best angels. Of course, some like Sequoia Capital, have already formalized their working relationship with angels via things like their Scout fund. In addition, we’re seeing LPs take more interest in angels with a view that many of these angels will go on to raise micro VC funds.

With all the interest in angel investors, the ability to track the efficacy of individual angel investors will become increasingly important.

Notes:

- Angel Investors associated with institutional funds were excluded from our list.

- Investments into companies at the early stages are included in this analysis. An angel investor investing in a secondary market round for a private company are excluded.

- Angel investments are a fairly opaque part of the innovation economy as angel investors may keep deals undisclosed.

Best Ever Video about the Tech Scene in CO, and why you should live here

Produced by Engine7 Media - www.engine7media.com. This video was created for the first ever Colorado Venture Summit. The event united venture capitalists with the founders and CEO's of Colorado's venture-backed information technology companies.

Startups Fail Because They Lack Customers, Not Funding

Thank you Diana Kandor, fellow at the Kaufman Foundation, for saying what should really be the obvious.

Startup founders, stop looking for money and go make it!

There's a misperception in the startup world that all you have to do is focus on the pitch and focus on getting investment. That couldn't be farther from the truth. Instead, companies need to focus on driving revenue as quickly as possible.

There's a notion that if you get into an accelerator, you're 100 steps ahead of all those other companies. Accelerators offer so much in terms of mentorship and structure and tips and tricks. They are hugely beneficial. And, yes, if you get accepted, your startup can get a huge leg up on the competition. Yet, even if you're lucky enough to get into a program and you're super savvy and leverage the learning you receive, and even if you're mega lucky and actually make it past pitch day and get a check in your hand, someone (and I recommend everyone) has to focus on the bottom line.

Let's say you hit a home run and get that round of funding, you now have a new boss and that boss wants to see a higher valuation. That boss cares little about your 17th iteration (unless the pivot really is led by consumer feedback) or how pretty your website or app is. She cares about how much traction you have, how fast you scale, how many users engage with your offering, and most importantly, she cares about the money.

The best way for startups to truly make it is to understand that everyone needs to assume the identity of rock-star salesperson and go out there and sell.

And, for the startups that have limited resources (basically everyone), go out there and have someone else do the work for you. That's right. Find the person with the best coat tails for your offering, and ride them.

Leverage the concept of leverage.

Here's the actual article

PRENTISS EARL III, POSTED: THURSDAY, JUNE 19, 2014 6:51 AM |UPDATED: 1:00 PM, THU JUN 19, 2014.

Carson Vaughan

Speaking before a crowd of more than 600 businessmen and women at the Lincoln Chamber of Commerce’s Economic Development Breakfast Wednesday morning,Diana Kander, senior fellow at the Kauffman Foundation, urged entrepreneurs to ditch the traditional business plan and adopt a more customer-based approach.

“The entrepreneurs would like to tell you they failed because they didn’t raise money or they had management team issues or maybe they had a bad location,” she said. “But the reality is they failed because they couldn’t get customers.”

Kander is not unfamilar to Nebraska, speaking at Big Omaha in 2013.

Incorporating examples from her own entrepreneurial history, Kander, whose talk was entitled “Why capital is no longer the most important barrier to startup growth,” said customers 15 years ago held very little power over their transactions with companies. They were “taken advantage of most of the time,” she said, and they settled for “good enough.”

“You would go to the car dealership just expecting to get hosed,” she said. “You just knew they were making money on a whole bunch of different levels.”

Today, customers have more control. They expect perfection.

“If there’s a product that you want, there are thousands of stores online where you can choose what you want,” she said. “So for the first time in a long time, the supply of stuff significantly outnumbers demand. That means anything you want, you can find the perfect product. You no longer have to settle.”

But despite a changing consumer landscape, the vast majority of companies still use the same model, largely steered by a speculative business plan that buries customer priority.

“We’ve seen in studies that those companies that raise venture capital—companies that raise $500K or more—75 percent of those companies fail,” she said. “So it’s not how much money you throw at the problem, it’s the fact that you’re trying to guess at perfection, at what customers want without actually knowing.”

Instead, Kander stressed the importance of iteration, explaining that startups must be willing to flex their initial idea to meet the customer upfront. To illustrate, she described the genesis of Hudl, the Lincoln-based sports-software company. Originally, Hudl thought of its product as a “varsity tool,” she said, but later expanded its market to include JV and freshman teams after reaching out to potential customers.

“The product they thought they were building was close, but it wasn’t perfect,” she said. “And they found out upfront, before they finished building the product, the perfect solution that people would be ready to hand money out for, and that accounts for a lot of their success today.”

Kander listed a handful of reasons more entrepreneurs aren’t adopting a customer-based approach. First, she said, too many entrepreneurs think they’re smarter than the customers. It’s also a harder model to follow; it feels less natural than the plan-based approach, in which the entrepreneur moves from the idea to development to branding and finally on to the customer. Lastly, she said, many entrepreneurs ask leading questions during the test phase and rely on unreliable vanity metrics, convincing themselves of a primed customer base.

“Making sure you have customers up front in your venture before you start implementing is the most important thing you can do to a venture or new idea,” she said, “more important than raising hundreds of thousands or even millions of dollars.”

Near the end of her presentation, Kander took several minutes to describe the “marshmallow challenge,” one of her favorite experiments. The challenge provides the participants 18 minutes to build the tallest freestanding structure from the following supplies: 20 sticks of pasta, one yard of tape, one yard of rope and one large marshmallow, which must stand on the top. All different groups have taken the challenge, she said, but in a match between MBA students and kindergartners, the kindergartners averaged a height 2.5 times taller (25 inches compared to 10).

The MBAs spent 30 percent of their time planning the structure and 60 percent building it, she said, only to watch the structure topple after placing the marshmallow on top. With what little time they had left, they cobbled together a short and poorly built structure ten inches tall.

“This is the traditional plan-based approach,” she said. “You come up with an idea and spend all your time building something and then you hope at the end that it will work, only to find that it doesn’t.”

The kindergartners, on the other hand, started with the marshmallow already on top. It’s a small structure, but it’s stable. They’ve spent very little time building it, so with extra time to kill, they start experimenting with it, adding pieces, playing.

“If you spend time upfront testing an idea before you dedicate resources to it, I guarantee you’re going to find huge opportunities. “

The Internet in Real-Time

Foundry Funds Nix Hydra, Mobile Game Maker for Girls

Brad Feld (Foundry co-founder) loves women. He has been active with several non-profit organizations and currently is chairman of the National Center for Women & Information Technology.

NCWIT is actually based right here in beautiful Boulder Colorado. They believe the people who build technology should represent the people who use it.

NCWIT says, "Although women today comprise half the world’s population and more than half of the U.S. professional workforce, they play only a small role in inventing the technology of tomorrow. The lack of girls and women in computing and technology represents a failure to capitalize on the benefits of diverse perspectives: in a world dependent on innovation, it can bring the best and broadest problem-solvers to the table; and at a time when technology drives economic growth, it can yield a larger and more competitive workforce."

Experiential play is how we learn and until now, most games and toys were set up to teach certain principles. Walk down any toy aisle in Target and you'll see pink, dolls and more pink.

That's why DisruptHER Productions, NCWIT, & Geena Davis Institute on Gender in Media created the first annual DevelopHer Challenge to design toys and games that engage girls ages 3-12 in science, technology, engineering, and math.

Brad and Foundry Group know that women are the next big win. And, now they've awarded $5 Mil in funding to two women who know how to create mobile games women (9 million of them so far!) will play.

Nix Hydra Scores $5M to Make Mobile Games for Girls, Not ‘Tech Dudes’

By Lizette Chapman

Striking a rare win in the male-dominated gaming sector, female-focused mobile gaming startup Nix Hydra Inc. has raised $5 million from Foundry Group to expand its hit game “Egg Baby” and launch new ones.

Co-founded in 2012 by former Yale classmates and startup vets Naomi Ladizinsky and Lina Chen, the Los Angeles-based startup is unapologetically focused on creating games by women and for women.

“This [mobile gaming] market is new, but so far we’ve seen a lot of repeats with the same ideas iterated on over and over again,” said Ms. Ladizinsky, referring to so-called runner, quest, battle and other genres. “It’s a tech dude’s perspective.”

To that end, Nix Hydra will use the fresh funding to build new games based on strong characters with complexity and consequences for irresponsibility, similar to “Egg Baby.”

The game launched last year, inspired by a school experiment entrusting students with a raw egg to experience the responsibilities of parenthood. The initial version of the game was rough, but it quickly gained favor among teenage girls and women despite no marketing.

With just one other employee to help, Ms. Ladizinsky and Ms. Chen scrambled to add more content and continue improving the game or risk losing momentum. The two had experience at startups–Ms. Li previously negotiated international mobile deals for streaming music startup Grooveshark Inc. while Ms. Ladizinsky directed, produced and edited digital content for gaming channel Machinima Inc.–but scaling a mobile game was new.

“We didn’t think it was going to be that popular,” said Ms. Chen of the game that has now been downloaded nine million times.

In “Egg Baby,” players each get an egg, which hatches into a unique gift-giving creature based on how the game-players wash, feed, tickle, dress, and otherwise interact with the eggs. Players like to show off the results of their work, with most new users finding the game because a friend shared their creature. If players forget to put their egg to bed or feed it, it dies.

Roughly 85% of players are women and most are under the age of 25, Ms. Chen said.

Raising the round happened fast and came following an introduction by the startup’s angel investors to Foundry Group.

“It was two phone calls and one in person,” said Ms. Chen of the 10-day process. “Foundry Group really got us.”

Nix Hydra expects to hire another 20 people during the next year, and it will use the funding to build a franchise around “Egg Baby” and launch two still-unnamed games.

Foundry Group led the Series A round with participation from Buddy Media co-founder Mike Lazerow and other individuals, at a valuation around $20 million.

Individual investors including Gyft Inc. co-founder Vinny Lingham, Mry Inc. co-founder Matt Britton and Riot Games investor Brad Schwartz previously invested around $600,000.

Write to Lizette Chapman at lizette.chapman@wsj.com. Follow her on Twitter at@zettewil

Guide for Boulder Tech Entrepreneurs

It's hard for these not to get outdated because we're growing so fast and there are so many new opportunities. That said, there are tons of events, organizations and a million resources all set up to create your success. Here are a few categories of incredible resources.

Silicon Flatirons Center

A Center for Law, Technology, and Entrepreneurship

at the University of Colorado launched BoulderStartups.org to bring these resources together.

This is what they have to say about their entrepreneurship Initiative:

Something special is happening in Boulder's entrepreneurial circles, and the world is taking notice that Boulder is a world-class location to start a business. In support of this creative environment, Silicon Flatirons helps stitch together the entrepreneurial fabric for the area's software, telecommunications and Internet startup communities.

Boulder.me

Says: Welcome to Boulder, a mountain town in the heart of Colorado with a thriving tech scene. This site is to help involve those new to the area or looking to meet new people, learn something new and give back to others.

Women Entrepreneurs Fight for Their Piece of the Pie

By Zoë Schlanger / May 7, 2014 5:47 AM EDT

On a clear Friday morning in April, in a room near the top of the New York Times building with a humbling view of lower Manhattan, the world’s financial epicenter, eight groups of women wait to pitch their businesses.

Women are pushing their way into the world of venture capital and building their own businesses.

They’re vying for $25,000 in early-stage investment by five so-called angel investors. First up is Miki Agrawal, who speaks casually, convincingly and fast. She has done this before. She locks eyes with the five investors, one by one, as she describes something every woman in the room can relate to—the fear of period leaks.

The line of underwear she developed with the other two women who founded Thinx would end that worry forever, she says, with four high-tech layers of fabric in the crotch. By the time she gets to the part where girls in developing countries often miss a week of school while they are menstruating simply because they lack proper sanitary supplies, and how her company would donate washable pads for every pair of underwear sold, the investors are nodding, totally into it.

The entrepreneurs have just completed something called the Pipeline Fellowship, which is trying to level the playing field for women in angel investing, an increasingly integral part of America’s capital formation. startups with at least one woman on their founding team are roughly 18 percent less likely to attract equity investors than their all-male counterparts, according to 2013 data from an ongoing survey by Emory University. Yet they are almost 20 percent more likely to have generated revenue—and that’s no small distinction in a world where the vast majority of venture-backed startups fail. Data collected by PitchBook found only 13 percent of all venture capital deals in the United States went to women in 2013, a significant increase from the firm’s 2004 data that put the figure at 4 percent. But that still means 87 percent of deals are being given to all-male teams.

The numbers paint just part of the picture. The rest is made up of the experiences—often ranging from frustrating to infuriating—of female entrepreneurs navigating the world of equity investors, where 96 percent of senior venture capitalists are men.

The anonymous confession-sharing app Secret is rife with posts by female entrepreneurs bemoaning the process of finding financial backers. “Just got out of a meeting with a [venture capitalist] who couldn’t stop staring at my boobs. Not sure whether this means we have a better or worse chance of getting his investment,” reads one.

Kathryn Minshew, who co-founded the career advice and job-search tool The Muse in 2011, says women are frequently asked to drinks by VCs who say they might be interested in investing. But instead of a business meeting, it turns out to be a date. Over the course of her company’s first year, Minshew says, she spent “probably 30 hours, maybe more” going on bait-and-switch drinks of that nature.

“One of the very common questions I get from younger entrepreneurs is, How do you very nicely confirm with an investor that something is a business meeting and not a personal meeting, without offending them?”

Natalia Oberti Noguera, the founder of the Pipeline Fellowship and a self-described “LGBTQ Latina and a feminist with a capital F,” has come to terms with that bias. That’s why the crowd assembled in the Goodwin Procter offices for the pitching event is almost entirely women. Just two men are in the audience, to support their co-founder Holly Pressman, who is pitching their finance-education site FinLit.com. Oberti Noguera’s program trains women to be angel investors, through mentoring with seasoned investors and workshops on issues like due diligence and valuation. The five women at the table in the pitch meeting—an insurance executive, a mortgage executive, two magazine executives and the vice chair of a New York City school, were nearing the end of the program, the part where they narrow down eight potential investments to three.

“People will probably invest in people who make them feel safe, and usually that means people who are not different. So if that’s how we work, let’s get more women and people of color on the investing side,” Oberti Noguera tells Newsweek.

In the first half of 2013, according to the Center for Venture Research, just 16 percent of companies pitching to angel investors were women-owned, but 24 percent of that group got funded—a higher rate of success than the deal rate overall. That may in part be thanks to programs like Pipeline Fellowship, Golden Seeds, 37 Angels and others like them. Angel investors back projects they feel passionate about, and that are in their early stages of development, in return for equity in the businesses. They are a different financial species from venture capitalists, who invest institutional money—from pension funds, university endowments, wealthy individuals—in much larger sums, and typically require a seat on the board of the business they back, as well as an equity stake.

In a study released by Harvard in March, investors, both men and women, heard real startup pitches adapted from real businesses. Each pitch was shown in one of four ways to different investors: in one version, a male voice presented the pitch alongside a photo of an attractive man. In another, the voice was male and the photo of the man was less attractive. Another two versions were narrated by a female voice, one with a photo of an attractive woman and one with a less attractive woman.

Investors chose businesses presented by men 68 percent of the time. Only 32 percent of investors chose to fund the ventures presented by women, despite the pitch being exactly the same. The pitches by more attractive men fared considerably better than the ones by less handsome, while better-looking women did slightly worse, by a negligible margin, than their less pretty female counterparts.

You read that right: Both men and women would rather invest in a man over a woman, especially if the fellow has the right look.

“It’s more about intuition than data,” says Deb Nelson, the executive director of Social Venture Network, which connects social entrepreneurs with socially conscious investors. In traditional profit-driven investment, especially with early-stage funding where data are scarce, the decision of who to fund can come down to which entrepreneurs look and sound as if they will succeed. As long as the image we conjure in our collective imagination of a capable business leader is an attractive (likely young, likely white) man, that intuition will look a lot like sexism, racism and ageism. “We need to unlearn how we’ve been socialized,” Nelson says.

Natalia Oberti Noguera founded the Pipeline Fellowship as a way to put more women on the other side of the table, deciding which companies to invest in. Bryan Thomas for Newsweek

PICKING WINNERS

Consider the story of a tech startup called Clinkle. Its 22-year-old white, male CEO, Lucas Duplan, raised $30 million in investment over the past year. Now, the company has laid off a quarter of its staff, lost its chief operating officer and has been christened a hot mess by the tech news website Re/code, all without putting out its product yet, an app to stealthily transfer payments between smartphones.

“I don’t think it was the app that was impressive,” one former employee told Business Insider. “I think it’s Lucas who is so compelling. He sells the vision of what every investor wants, which is a 20-year-old, white, male Stanford computer science major. He fits the bill. He appears to be the next Mark Zuckerberg, and he carries himself that way.” Duplan declined to comment for this story.

Oberti Noguera says there’s a wider lesson to be learned from such stories.

“If a guy has a really great exit, then of course that guy was awesome. And if a guy doesn’t do well, it’s like, ‘Well, he must’ve not had the pricing strategy down pat.’ But if a woman doesn’t end up succeeding, it’s ‘Oh, women suck,’” she says. “We don’t have enough female success stories, so the failure stories end up overshadowing everything. We have so many white–guys stories, but that doesn’t mean that if the guy is white and wearing a hoodie that he’ll succeed.”

If looks aren’t a good benchmark for investors, what is? A 2012 report from Dow Jones found that a company with at least one female executive at the vice president or director level was more likely to be successful than companies with no women at that level. For venture-backed startups with five or more female executives, the report found 61 percent were successful and only 39 percent flopped, compared with a 50 percent failure rate overall. The study did not find any statistically significant relationship between a company having female founders and its success, perhaps because there were so few represented: Of the 20,194 companies in the report, only 1.3 percent had a female founder.

There are those who argue women need to adapt to the system, rather than the other way around—that it’s the women themselves who are to blame. And not all of these critics are unreconstructed Mad Men–era throwbacks.Bryan Thomas for Newsweek

“VCs don’t have a bias against women entrepreneurs; we’re just bad at pitching,” claimed a headline on the website Venture Beat last year. The author, Mauria Finley, a woman who founded Citrus Lane, a subscription service for children’s products, says women don’t think big enough and spend too much time focusing on details. In The Boston Globe magazine, Fiona Murray, one of the authors of the Harvard study, wrote that women should “watch sports” to have something to chat about with male investors.

“Women have to do things proactively against a tide of bias,” Murray tellsNewsweek, adding that “it’s not to say those biases are okay. It’s not just what women can do, it’s what men can do too.”

All the investors Newsweek spoke with say that having something in common does make an enormous difference to winning their support. Having a personal connection with the proposed product also makes a difference.

According to a study of a wide range of corporate firms by the Center for Talent Innovation, 56 percent of employees said the leaders at their companies didn’t value ideas they don’t personally see a need for, “even when there [are] strong data and evidence that it’s a good, marketable idea.”

Jules Pieri, who founded e-commerce site The Grommet in 2008, says she has seen that in action. “Every woman has heard this if her business has a consumer side to it: They say, ‘I’ll go ask my assistant, I’ll go ask my wife about this.’ And you just want to jump out the window,” she says.

Bryan Thomas for Newsweek

BLOWING UP THE MODEL

Projects like the Pipeline Fellowship are focused on getting more women with resources to invest in other women. But such solutions operate within the equity-investing system. Danae Ringelmann wants a better system: online crowdfunding campaigns, housed on sites like Indiegogo, which she founded in 2007. She says 47 percent of the projects that reach their funding goal on Indiegogo are female-led.

“Being able to sell your idea to one person is a dependency that really shouldn’t matter. You’ve changed your whole approach for that one person, what you think that one person wants to hear,” Ringelmann says.

Before Indiegogo, she worked in investment banking. One day, she went to an event in New York City, where people making films and theater productions could meet potential investors, even though she didn’t have the money or influence to fund a project. One director approached her, hopeful that she could help make his production of Arthur Miller’s Incident at Vichy an off-Broadway reality.

She co-produced a concert reading—where potential investors can attend and consider whether to invest. Ringelmann ultimately couldn’t gather enough capital to get the play staged, partly because she didn’t have a personal relationship with enough theater investors.

“The people who wanted the play to come alive the most didn’t actually have the power relationships to make it happen,” she says. Years later, Indiegogo came out of that sobering experience. “We decided to use the Internet to blow that [model of capital] up,” Ringelmann says.

Indiegogo has helped thousands of entrepreneurs get started. Businesses that want to seek traditional investment later have used the success of their Indiegogo projects as proof of their project’s viability, according to Ringelmann.

For its part, Indiegogo still needed venture capital to get off the ground. Ringelmann says her team was rejected by over 90 venture capitalists before they raised their first VC dollar. But now the funding appears to be flowing: In January, the site announced it had raised $40 million in Series B venture funding, the funding stage meant to speed growth.

CASINO ROYALE

A fact that gets lost in all the bleak reports about the capital gap is that women start many successful businesses without VC funding. Indeed, women own 30 percent of all businesses in the United States. Many choose not to approach investors in the first place. Instead, they grow their businesses at a rate directly proportional to their businesses’ success.

The point of venture capital isn’t necessarily to grow a sustainable business. The point is to make a lot of money. The VC’s investment is worthwhile only if and when the company has a major liquidity event, called an “exit,” by either being bought or going public. Exits are very rare, and most VC-backed startups fail.

When a fledgling business makes a successful pitch and receives a sudden injection of millions of venture capital dollars, it has often made an agreement to grow as fast as possible. Perhaps it moves into offices and goes on a hiring spree. It’s racing toward the exit.

For all their expertise, venture capitalists are basically shooting craps, only with worse odds. Just 2.3 percent of venture capital deals end in a payout of more than $100 million, and 0.18 percent get a payday that exceeds $1 billion, but those are the margins that major firms are gunning for. More than 90 percent of venture capital-backed startups fall short of their projected success, according to Harvard Business School research. Fully 45 percent fail entirely and return nothing to investors, according to data from Sand Hill Econometrics. Another 25 percent might make some money, but fail to return all of the original investment. In both cases, or around 70 percent of the time, the entrepreneur walks away with nothing at all.

MIT engineer Limor “Ladyada” Fried didn’t seek out any investors when she founded Adafruit, her a DIY electronics kits company, in 2005. Adafruit had over $22 million in revenue in 2013 and is expected to double its 50-person staff this year. Fried isn’t opposed to venture capital or angel investment, but with a company that focuses on education and “making more engineers,” rather than short-term profit, Fried doesn’t see how the equity investment model would fit in, at least for now.

Adafruit has more than 1,800 products for sale and is engineering new ones all the time. It recently launched a new children’s show about electronics called Circuit Playground. An investor might consider all those diverse focuses “outside the core business” of shipping out kit orders, but it’s just how Adafruit does things, Fried says.Bryan Thomas for Newsweek

“Had we taken investment and not constrained growth, we could have made some mistakes with hiring and space. It’s given us more flexibility to not have the pressures of a return on investment from an outside group. We’re growing at our own pace and on our terms,” Fried says. “There hasn’t been a challenge that a cash infusion could solve. And we know that taking on investment and investors would take one important thing away that cash definitely cannot solve: time.”

It’s a lesson women and men could take to heart.

Boulder Startup Week

Boulder Startup Week is May 12-16, 2014!

Boulder Startup Week started in 2010 as the first Startup Week in the nation with the goal of connecting, educating, engaging and drinking with the best community in the world. Now in the fifth year, BSW aims to welcome newcomers to town and help make professional and personal connections. Follow us on Twitter and Facebook for updates as they're released (which will be soon, so stay tuned!)

Go to the site and RSVP for one of the 50 amazing events next week.

The Fort Collins Startup Scene

Fort Collins Startup Week, slated for May 20-25th, is bringing in the heavy hitters and cash resources to match, to make significant, positive economic change for one of the nations leading yet lesser known innovation hubs, Fort Collins, Colorado.

The event co-chaired and produced by Launch Haus, a local venture catalyst firm, kicks off the week with the well-known futurist and five-time author, Gerd Leonhard. General Admission tickets for FCSW are available at no charge at http://www.ftcstartupweek.co

So excited to be working with Chris Snook, Simla Somturk and a thousand others who are celebrating Ft. Collins in this month's Startup Week. No press yet and already 1200 people have signed up to attend.

How to get an effective email introduction

Boulder TechStar Company Conspire has some ideas for you.

Alex Devkar, CEO

A well-executed introduction to whoever you want to meet—a potential customer, employer, employee or investor—can be the difference between success and failure. Here are the most important points to remember.

Give your friend an email she can forward. When you ask for an intro, remember that you’re asking your friend for a favor. Make it easy on her. Your friend should be able to forward your message on to your target without doing any work. If you do it right, she can do this from her phone.

In order to make this possible, your email needs to be self-contained. Your friend may know everything about you, but your target does not. Describe who you are and why you want to meet.

Keep it short. Busy people are drowning in email. You show respect for everyone’s time and have a better chance of success by getting to the point quickly.

From: Alex Founder

To: Diana Friend

Subject: Intro to John InvestorHi Diana,

As you know, we’re raising a seed round and would love to talk to John Investor. Could you put us in touch? A brief description of what we do is at the bottom of this email.

Thanks,

Alex

My company (ExcitingCo) improves corporate wikis by letting employees pull important content out of email and into the appropriate wiki with one click. We ran a private beta with 100 companies over the last 3 months. We just opened it up to the public and are signing up paying customers now.

Diana can then forward it on with a recommendation.

From: Diana Friend

To: John Investor

Cc: Alex Founder

Subject: Fwd: Intro to John InvestorJohn, please meet my friend Alex. His company is doing exciting things. I think you’ll be very interested.

Sent from my mobile device

On Mar 28, 2014, at 10:42 PM, Alex Founder wrote:

…

This is a great start to the introduction, but your work isn’t done.

Follow up immediately. As soon as your friend connects you to your target, you should follow up. It is your responsibility to drive the process. Thank your friend for making the intro and move her to bcc, so she doesn’t get spammed with the scheduling details.

Make a clear ask. Don’t make the next step for your target ambiguous by saying something like: “Let me know what you think.” Be direct.

From: Alex Founder

To: John Investor

Bcc: Diana Friend

Subject: Intro to John InvestorThanks, Diana! (to bcc)

John, great to meet you. Do you have availability for a 10 minute call next week? I’ll work around your schedule.

On Mar 28, 2014, at 10:42 PM, Diana Friend wrote:

…

Always be respectful, responsive and prepared. No matter what happens with your target, remain professional. Your friend vouched for you by making the introduction. You’re trading on her reputation as well as yours.

The multi-step dance Alex Founder went through above won’t fit every situation, but the tips will help you get effective introductions. If you want to know who the best person in your network to ask for an intro is, check out Conspire.